As the economy and the housing market have slowly recovered in 2012, it will come as no surprise that pine timber prices in the US South are higher in 2012 than they were in 2011. They are still lower than 2010 prices, however. Why is this? Even though demand is strengthening, supply is generally sufficient to meet demand because stumpage offerings are on the rise. Here are the highlights:

- Increased demand is encouraging timberland owners (many of whom withheld their timber from the market during the downturn) to harvest. According to Forest2Market's Stumpage Price Database, the year-over-year change in the number of timber sales from 2009-2012 has been:

- 2009-2010: -6%

- 2010-2011: +2%

- 2011-2012: +13%

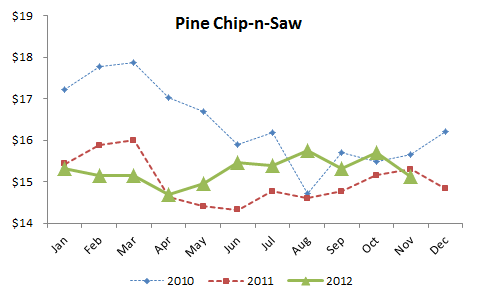

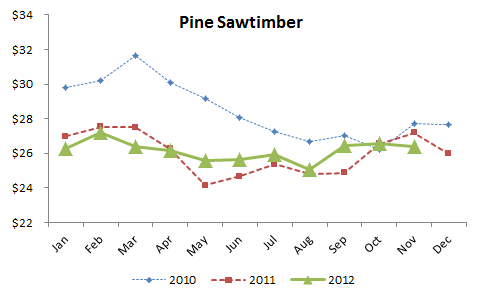

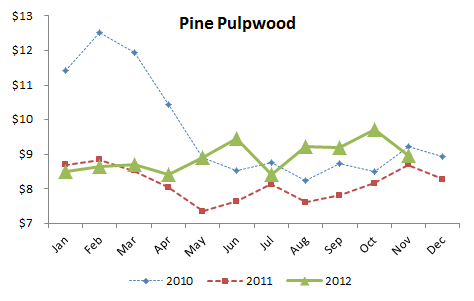

- Prices have steadily increased since their April-May 2012 lows, though current numbers are pointing to a decline in November for all products.

- Chip-n-saw and sawtimber are falling under 2010 and 2011 levels.

- Pine pulpwood is under 2010 and closely approaching 2011 levels.

Note: All prices in $/green ton.

- Pine pulpwood prices have steadily increased since May 2011.

- On average, prices in the last 6 months have been higher than 2010 and 2011.

- Why? Upward price movement in chip-n-saw and sawtimber has driven pine pulpwood prices higher.

Note: All prices in $/green ton.

- Pine chip-n-saw prices have increased since April 2012.

- Most of the increase was observed in the 2nd quarter of 2012.

- Since then, the price trend has been flat with the current month showing the steepest decline, under both 2010 and 2011 levels.

Note: All prices in $/green ton.

- Pine sawtimber prices have steadily increased since May 2011, but did not peak in November as they did in 2010 and 2011.

- The largest increase occurred in September and held through October.

- November’s price has fallen beneath 2010 and 2011 levels.

To sum up the market for pine stumpage at the end of 2012 and looking into 2013:

- September and October’s housing starts were a surprise to many and have definitely interjected demand for sawtimber in the market. (Construction spending and remodeling activity also increased.)

- Landowners have reacted by increasing sales offerings.

- November may point to a short-term weakness or correction in the market, but panic should not ensue. Why?

- Mills have steadily built inventories over the last four months and seem to have reached a comfort level for now.

- But overall trend through 2012 points to steady demand leading to a stronger market as we enter 2013.

Daniel Stuber

Daniel Stuber