US forest industry performance in April and May was recently reported by both the US government and the Institute for Supply Management.

Total industrial production (IP) rose 0.7 percent in April (+3.5 percent YoY) for its third consecutive monthly increase. After modestly negative annual adjustments to IP published in March, the rates of change during prior months were revised further downward, on net, by 1PP; for 1Q2018, output is now reported to have advanced at an annualized 2.3 percent (previously 4.5 percent).

After being unchanged in March, manufacturing output moved up 0.5 percent in April; for 1Q, the index registered a downwardly revised, annualized rate of +1.4 percent (previously 3.1 percent). In April, the indexes for durables and nondurables each gained about 0.5 percent. Among durables, advances of more than 1 percent were posted by machinery; computer and electronic products; electrical equipment, appliances, and components; and aerospace and miscellaneous transportation equipment. The largest losses were incurred in motor vehicles and parts (-1.3 percent) and wood products (-1.2 percent). The increase in nondurables reflected widespread gains (e.g., paper products: +0.4 percent).

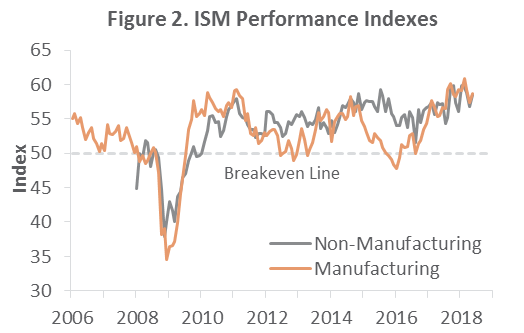

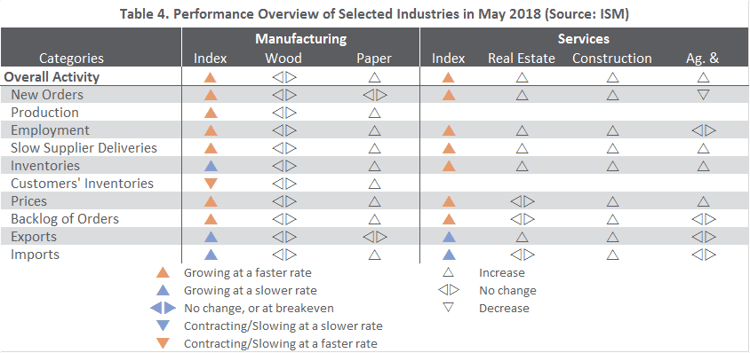

The Institute for Supply Management’s (ISM) monthly sentiment survey showed that the expansion in US manufacturing accelerated in May. The PMI registered 58.7 percent, up 1.4PP from the April reading. “This indicates strong growth in manufacturing for the 21st consecutive month,” said ISM’s Timothy Fiore, “led by continued expansion in new orders, production and employment.” Most noteworthy, the Prices Index inched up to its highest level since May 2011; 62.2 percent of respondents reported paying higher prices while 34.7 percent paid the same prices as in April.

The pace of growth in the non-manufacturing sector also rebounded (+1.8PP) to 58.6 percent. The non-manufacturing price index was less of an outlier; still, 41 percent of respondents reported higher prices whereas 54 percent indicated no change.

The consumer price index (CPI) increased 0.2 percent in April, mainly thanks to gasoline (+3.0 percent MoM; +13.4 percent YoY) and shelter (+0.3 percent MoM; +3.4 percent YoY). The CPI rose 2.5 percent for the 12 months ending April; the YoY figure has trended upward since June 2017’s +1.6 percent.

The producer price index (PPI) rose 0.1 percent (+2.6 percent YoY); the index for final demand services advanced 0.1 percent (especially in transportation and warehousing services), whereas prices for final demand goods were unchanged.

Forest products sector performance included:

- Pulp, Paper & Allied Products: +0.2 percent (+1.5 percent YoY)

- Lumber & Wood Products: +0.1 percent (+6.5 percent YoY)

- Softwood Lumber: -1.9 percent (+9.9 percent YoY)

- Wood Fiber: -0.1 percent (+3.5 percent YoY)

We see QoQ changes in the CPI fluctuating between +1.1 percent and +4.0 percent annualized rates, for an overall average of +2.7 percent. The PPI will range between +1.3 percent and +3.7 percent, averaging +2.9 percent overall.