US forest industry performance in October and November was recently reported by both the US government and the Institute for Supply Management.

Total industrial production (IP) rose 0.9 percent in October (+2.9 percent YoY), and manufacturing increased 1.3 percent. The index for utilities rose 2.0 percent, but mining output fell 1.3 percent, as Hurricane Nate caused a sharp but short-lived decline in oil and gas drilling and extraction. Even so, industrial activity was boosted in October by a return to normal operations after the disruptions of hurricanes Harvey and Irma in August and September. Excluding the effects of the hurricanes, the index for total output advanced about 0.3 percent in October; manufacturing: +0.2 percent.

A more extensive lookback at manufacturing indicates this metric has yet to regain the level achieved just before the Great Recession. That inventories have been accumulating despite manufacturing IP (MIP) sitting about one-third below what it might be had MIP growth remained on its pre-Great Recession trend line suggests the “demand side” of the economy is less robust than the typical economic news headline would lead one to believe.

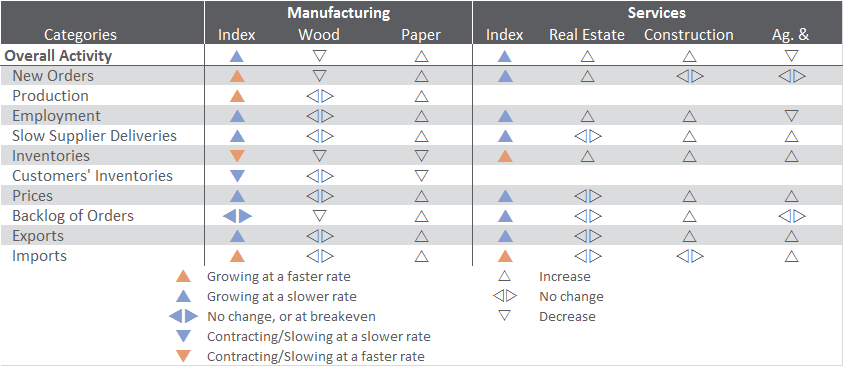

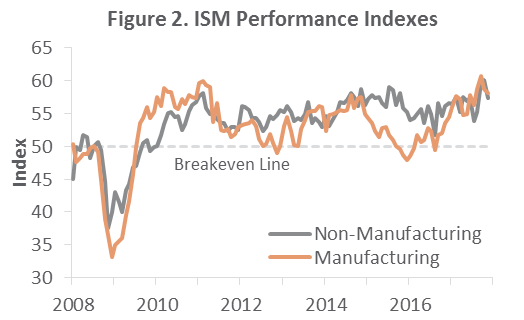

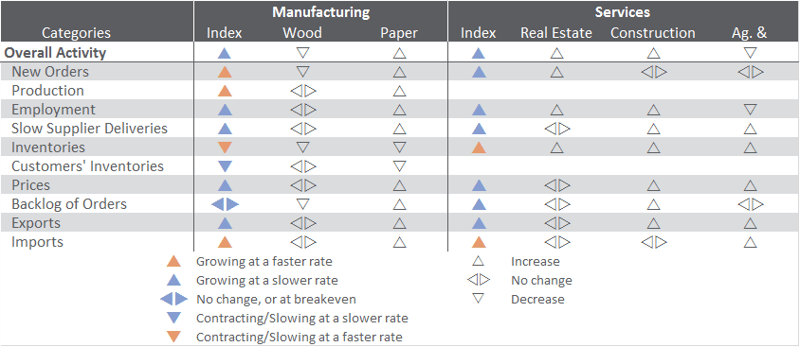

The Institute for Supply Management’s (ISM) monthly sentiment survey suggested that the expansion in US manufacturing decelerated in November. The PMI registered 58.2 percent, down 0.5 PP. Only new orders, production and imports exhibited higher values in November than in October.

The pace of growth in the non-manufacturing sector also slowed (-2.7 PP) to 57.4 percent. Inventories and imports were the only sub-indexes with higher values in November. Of the industries we track, Wood Products and Ag & Forestry contracted; Paper Products, Real Estate and Construction expanded.

The producer price index (PPI) increased 0.4 percent in October (+2.8 percent YoY), on a combination of rising prescription drug-manufacturing costs and wider margins for fuel retailing. Forest products sector performance included:

- Pulp, Paper & Allied Products: -0.6 percent (+2.8 percent YoY)

- Lumber & Wood Products: +0.7 percent (+4.1 percent YoY)

- Softwood Lumber: +2.3 percent (+15.4 percent YoY)

- Wood Fiber: +0.2 percent (-2.0 percent YoY)

The consumer price index (CPI) edged up by 0.1 percent in October (+2.0 percent YoY), primarily the result of a 0.3 percent increase in the shelter index (+3.2 percent YoY). The energy index fell 1.0 percent (+6.4 percent YoY), as a decline in the gasoline index (-2.4 percent MoM; +10.8 percent YoY) outweighed increases in other energy components.

Joe Clark

Joe Clark