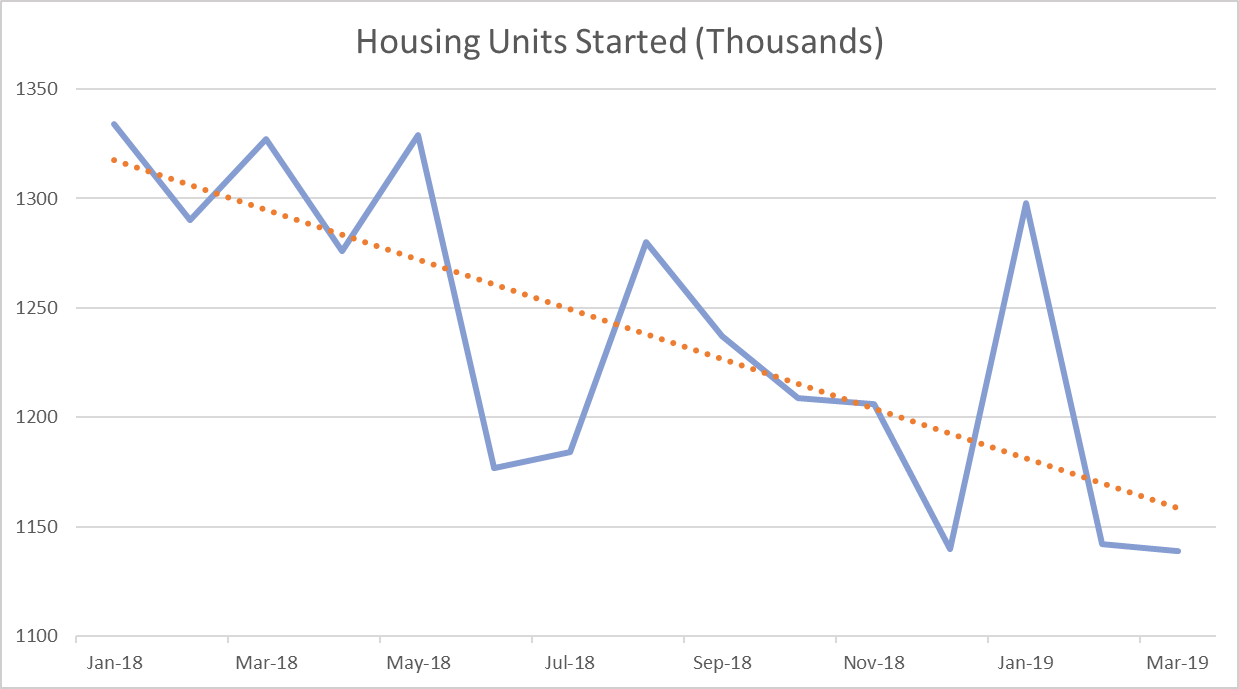

US housing starts fell unexpectedly in March, coming off a poor performance in February when single-family builds dropped to an 18-month low. Despite lower mortgage rates, higher wage growth and other economic indicators holding steady, there hasn’t been enough buyer activity to ignite a new wave of housing starts activity in recent months.

Housing Starts, Permits & Completions

After dropping 8.7 percent in February, privately-owned housing starts inched down 0.3 percent in March to a seasonally adjusted annual rate (SAAR) of 1.139 million units. Single-family starts dropped 0.4 percent to a rate of 785,00 units; starts for the volatile multi-family housing segment were unchanged at a 354,000 pace in March.

For the second month in a row, privately-owned housing authorizations were down 1.7 percent to a rate of 1.269 million units in March. Single-family authorizations were down 1.1 percent at a pace of 808,000 units. Privately-owned housing completions were down 1.9 percent to a SAAR of 1.313 million units. Per the US Census Bureau Report, seasonally-adjusted total housing starts by region included:

- Northeast: -4.4 percent (-29.5 percent in prior month)

- South: -7.2 percent (-6.8 percent in prior month)

- Midwest: -17.6 percent (+26.8 percent in prior month)

- West: +31.4 percent (-18.9 percent in prior month)

Seasonally-adjusted single-family housing starts by region included:

- Northeast: +18.8 percent (-42.0 percent in prior month)

- South: -2.8 percent (-12.1 percent in prior month)

- Midwest: -21.1 percent (-8.3 percent in prior month)

- West: +13.9 percent (-24.4 percent in prior month)

The 30-year fixed mortgage rate continued to decline in March, dropping to 4.27 percent for the month. The rate has dropped 12.3 percent since peaking at 4.87 in late November 2018. Mortgage rates during 1Q2019 included: 4.46 in January, 4.37 in February and 4.27 in March.

A recent Reuters article noted that “The weak report bucked a recent tide of upbeat data, including retail sales, trade and construction spending, that indicated the economy regained speed late in the first quarter after appearing to stumble at the turn of the year.” "Waiting for construction activity to pick up after a sharp drop in mortgage rates is like waiting for Godot," said Chris Rupkey, chief economist at MUFG in New York. "It is hard to know what is ailing the home construction industry."

Housing Market Analysis

Delphi Advisors provide analytical insights into the housing starts data and implications for the larger housing market in Forest2Market’s most recent issue of The Economic Outlook:

“We remain guardedly optimistic about the housing market this year,” wrote Mortgage Bankers Association (MBA) analysts in late March. “Along with lower mortgage rates, prospective buyers in some markets have seen an increase in homes for sale, which provides more options and has stemmed some of the rapid home price growth that we have seen for so long.” As a result, MBA now expects total mortgage originations in 2019 to rise relative to 2018.

Trulia holds a somewhat contrasting view. “Cyclical housing market downturns occur roughly every 10 years, and they typically don’t happen overnight. Instead, they play out steadily over a few years, first showing up in sales volumes and later—usually a year or two later—in prices,” Trulia wrote. “The housing market currently appears to be in the early stages of such a downturn: declining sale volumes and other market indicators indicate that it is cooling off, gradually pivoting away from the heated sellers’ market of recent years.”

In the short run, however, Trulia believes the housing market will do “just fine.” “The downturn we’re entering is inherently different from the previous one that saw home values plummet over 40%, and is likely to be mild,” Trulia continued. “Declining sale volumes will probably be followed by small declines in prices or possibly just a prolonged period of flat-to-modest housing price growth.”

The view of a slowdown in residential construction activity seems to be borne out by data showing that, between August 2018 and January 2019, single-family permits lagged behind completions. When completions exceed permits, the sector is not expanding. We used single-family statistics for this determination because the multi-family component is in perennial “deficit.” The last period during which multi-family completions (C) exceeded permits (P) spanned October 2008 to July 2010; the C/P ratio since July 2010 averaged 0.68. One could infer from the excess of multi-family permits relative to completions that either many permitted projects “die on the vine” (which would be a tremendous waste of builders’ financial resources) or the Census Bureau faces methodological challenges with data collection.

An issue that bears watching is an observation by CoreLogic that average debt-to-income (DTI) ratios for conventional conforming home-purchase loans rose during 4Q2018 and were the highest since 2009. Because the average 4Q2018 loan-to-value and credit scores were essentially unchanged from 4Q2017, it appears lenders are not repeating the most egregious mistakes that led to the housing bust and Great Recession. Nonetheless, higher DTI ratios could contribute to a spike in mortgage defaults if the economy experiences a sharp and/or protracted downturn.

With 1Q behind us, we think total starts will fluctuate between SAARs of 1.024 and 1.282 million units (MU), with 2019 averaging 1.198 MU (-5.1 percent compared to 2018).