3 min read

US Housing Starts Inch Down in April; ‘Demographic Tailwind’ at Risk

John Greene

:

May 29, 2018

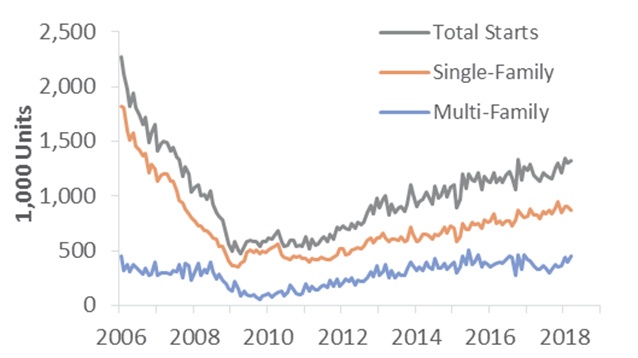

US housing starts were down in April, suggesting that factors such as rising materials and labor costs are restricting new residential construction despite solid demand. These concerns continue to pose challenges to home builders seeking to meet demand and keep escalating housing prices in check.

Housing Starts, Permits & Completions

After inching up 1.9 percent in March, US housing starts decreased 3.7 percent in April to a seasonally adjusted annual rate (SAAR) of 1,287,000 units. Single-family starts accounted for 894,000 units, which is 0.1 percent above the revised March figure of 893,000. Starts for the volatile multi-family segment dropped 11.3 percent to a rate of 393,000 units in April.

Privately-owned housing authorizations dropped 1.8 percent to a rate of 1,352,000 units in April. Single-family authorizations ticked up to 859,000, which is 0.9 percent above the revised March figure.

Privately-owned housing completions increased to a SAAR of 1,257,000 in April, up 2.8 percent from March’s revised estimate of 1,223,000 and 14.8 percent above April 2017. Regional performance in March was mixed as confirmed by the US Census Bureau report, although the Midwest experienced significant month-over-month volatility. Seasonally-adjusted total housing starts by region included:

- Northeast: -8.1 percent (+0.8 percent last month)

- South: +6.4 percent (-0.6 percent last month)

- Midwest: -16.3 percent (+22.4 percent last month)

- West: -12.0 percent (-1.5 percent last month)

Seasonally-adjusted single-family housing starts by region included:

- Northeast: -9.7 percent (-9.4 percent last month)

- South: +17.2 percent (-9.8 percent last month)

- Midwest: -29.8 percent (+37.7 percent last month)

- West: -10.1 percent (-8.7 percent last month)

The 30-year fixed mortgage rate increased from 4.44 to 4.47 percent in March, its highest level since September 2013. The National Association of Home Builders (NAHB)/Wells Fargo builder sentiment index was up one point to 70 in early may; this is the fourth time the index has reached 70 or higher this year.

Current Housing Market Dynamics

Some of the regional disparity in performance could be due to atypical snow and weather patterns, said Scott Volling, principal at PricewaterhouseCoopers. “But, if you take a step back and look at a more macro level, the quote I hear most often from builders is, ‘we can’t outbuild our labor.’ They may have lots ready to go, and there may be demand out there, but they can’t go any faster than their labor pool allows them to,” Volling added.

Rising material costs also threaten the momentum of single-family home construction; lumber costs have risen significantly since the beginning of 2017, adding roughly $7,000 to the cost of building a home, per Robert Dietz, chief economist at the NAHB. Dietz added that single-family building has proven “remarkably resilient” to rising interest rates and higher construction costs. That said, there will come a point at which the market will resettle.

Other trends and dynamics are at work within the larger housing market, as recently reported by Delphi Advisors in Forest2Market’s Economic Outlook:

- As a multiple (ratio) of median household income (MHI), new-home prices are at an extreme (roughly 5.7 times MHI) beyond even the peak of the housing bubble (5.2X MHI), while existing home prices are about 5 percent below their prior peak. Based on this data, why have home sales not begun to retreat? “Demographic tailwinds,” in part, as millennials of peak first-home-buying age are a demographic of sufficient (and increasing) size to overcome the stresses imposed on them by the economy.

- Unlike during the pre-2008 housing bubble—when apartment vacancies were high and rents were cheap—rents are now also at an extreme relative to MHI. Median rent for an apartment was 13.7 percent of MHI in 2000, but 19.3 percent in 1Q2018.

- Even with recent increases, mortgage interest rates are still lower now than they were during the housing bubble. The median mortgage payment was slightly above 40 percent of MHI in 1988. After falling below 28 percent a decade later, it reached a secondary peak of 35 percent in 2Q2006. Since the cycle low of 23 percent in 2011, and with rising home prices and mortgage interest rates, the median mortgage payment in 1Q2018 was an estimated 29.5 percent of MHI.

During the last 30 years, monthly mortgage payments have fallen from over 3X median rent to about 1.5X now. At the peak of the housing bubble, the monthly carrying cost of a house was about 2.3X the median cost of renting an apartment, which fell to 1.4X at the bottom of the bust. For the last five years, monthly mortgage payments have hovered near 1.5X median asking rent.

- If the trends of rising prices and interest rates continue, at some point they will overcome the millennial demographic tailwind. If that occurs, there may be another deflationary bust. Skyrocketing prices, tight supply and high down payments are shutting a number of prospective first-time buyers out of the market. However, mortgage payments are still lower in relative terms than they were at the peak of the housing bubble despite the recent uptick in interest rates; also, mortgage payments are a relative bargain compared with their historical multiple of rental payments.

Along with the demographic tailwind, the comparitive inexpensiveness of monthly mortgage payments versus rental payments helps to explain why single-family home construction has continued its modest upward trend in the face of higher mortgage rates.

Two key items to watch in the near term: interest rates and housing costs. If either increases too far beyond current levels and, most importantly, if home builders continue to focus only on the more expensive segments of the market, a potential affordability crisis awaits. The combined effects of which will simply overwhelm the increasing number of millennials who have been propping up the market, resulting in a demographic headwind that will likely cause the market to decline as a result.