US housing starts increased in February as unseasonably warm weather allowed for the construction of new single-family houses, which suggests that the economy is on solid (if cautious) footing. The general sense of economic optimism is evident in other recently-released data, which shows a drop in the number of Americans filing new applications for unemployment benefits—a sign of a tightening labor market. This positive data came a day after the Federal Reserve raised interest rates for just the third time since the Great Recession of 2008.

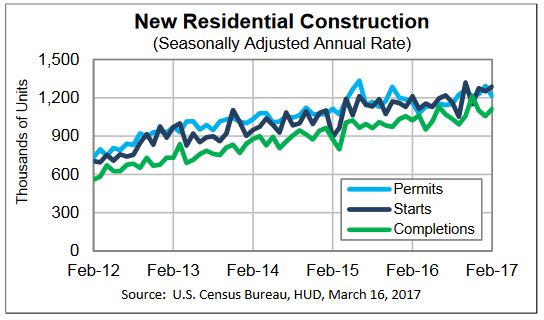

Housing Starts, Permits & Completions

Housing starts ticked up 3.0 percent to a seasonally adjusted annual rate (SAAR) of 1,288,000 units in February. Single-family starts accounted for 872,000 units, which is 6.5 percent above the revised January figure of 819,000. The volatile multifamily segment dropped 3.7 percent to a SAAR of 416,000.

Single-family permits rose 3.1 percent to a rate of 832,000 units in February, while multifamily permits dropped 21.6 percent. Privately-owned housing completions were 5.4 percent above January’s estimate of 1,057,000 units.

Regional performance was less volatile than it has been in recent months, as confirmed by the US Census Bureau report. Seasonally-adjusted housing starts by region included:

- Northeast: +16.7 percent; (+55.4 percent last month)

- South: -2.6 percent; (+20.0 percent last month)

- Midwest: +20.0 percent; (-17.9 percent last month)

- West: +16.8 percent; (-41.3 percent last month)

Mortgage Rates & Market Sentiment

The 30-year fixed mortgage rate ticked up in February from 4.15 percent to 4.17 percent, which still represents a significant increase compared to the average 2016 rate of 3.65 percent.

The National Association of Home Builders (NAHB) recently released a new report showing that homebuilder confidence jumped to its highest level in almost twelve years. The NAHB/Wells Fargo Housing Market Index surged to 71 in mid-March from 65 in February (economists had expected it to inch up to 66). This surprise increase pushed the housing market index to its highest level since June of 2005.

NAHB chief economist Robert Dietz said in a statement that, “While builders are clearly confident, we expect some moderation in the index moving forward. Builders continue to face a number of challenges, including rising material prices, higher mortgage rates, and shortages of lots and labor.”

Rising Costs & New Lumber Markets

A resolution to the Softwood Lumber Agreement (SLA) is still not within sight, which is a concern for builders trying to control material costs heading into the spring season. At a recent annual meeting of LBM Advantage—a lumber and building materials purchasing co-op—Jerry Howard, chief executive officer of NAHB stated, "I think it's going to take four to five years to have a resolution to the Softwood Lumber Agreement. Builders are telling me they are having trouble getting commitments for the lumber packages for some of their products. The lumber issue is one that's extremely relevant and is slowing down the spring selling season.”

Howard suggests that US lumber manufacturers export less and focus their sales efforts on the domestic market. But even without a resolution to the SLA, a number of foreign lumber producers are seeing real opportunity within the US market based on a number of factors. As Pete Stewart noted at the beginning of the year, “Swedish sawmills are consolidating and, in the process, they will be more competitive on a global level. They are keen on a Canadian lumber quota, which, given their new-found cost reduction and the strong US dollar, will allow them to reach US markets in 2017 with a high-quality lumber product. The Baltic countries are right in line behind the Swedes.”

Howard also believes that Chilean producers are well-positioned to take advantage of the current situation in the American market; Chile ranks second to Canada for softwood lumber imports to the United States. "I spent 10 days down there [Chile] meeting with ministers and the industry," Howard said. "They're very interested in producing Chilean lumber to US standards… and becoming a permanent solution for Canadian lumber." This may take a few years to develop, but given how long the Canadian impasse is likely to last, "it's worth pursuing Chilean lumber," he added. Howard also plans to visit Brazil later this year.

Despite the mild February temperatures, winter weather has been pounding the Northeast and US South with blizzards and sub-zero conditions, which may leave the southern agriculture industry hardest hit. It will also have an impact on home buying/selling and construction feasibility, which may delay the traditional spring housing frenzy.