5 min read

US Imposes Canadian Lumber Tariffs in Absence of New Softwood Lumber Agreement

John Greene

:

April 27, 2017

In his first 100 days in office, President Trump is making good on a central component of his campaign platform: examining and renegotiating trade deals that will be in “America’s best interest.” While he has recently backed off some of the heated campaign-trail rhetoric aimed at China, his administration has instead taken issue with Canada. After trade talks on Canadian dairy products fell through, Commerce Secretary Wilbur Ross recently said that stiff new tariffs on softwood lumber shipped into the US will be imposed.

"It has been a bad week for U.S.-Canada trade relations," said Secretary Ross. "This is not our idea of a properly functioning Free Trade Agreement."

These are the first tariffs imposed by President Trump, which come as the US, Canada and Mexico prepare to renegotiate NAFTA. The tariffs ranged from 3 percent to 24 percent for five specific Canadian lumber companies, and a nearly 20 percent tariff on exports to the US for all other Canadian lumber companies. Per the US Department of Commerce, the following levies will be applied to the five specified producers:

- West Fraser: 24.12 percent

- Canfor: 20.26 percent

- Tolko: 19.50 percent

- Resolute: 12.82 percent

- D. Irving: 3.02 percent

The Trump administration didn't provide additional details about the discrepancy in duties that will apply to these companies, or why the others had to pay a 20 percent tariff. The US Commerce Department only said the duties were commensurate to the subsidies the companies received from the Canadian government. According to the Department, the duties listed above are preliminary and a final determination will be made in September. Imports of softwood lumber from Canada were valued at an estimated $5.66 billion in 2016.

Reactions from Both Sides of the Border

"The Government of Canada disagrees strongly with the U.S. Department of Commerce's decision to impose an unfair and punitive duty," said Jim Carr, Canada's Minister of Natural Resources, and Chrystia Freeland, Canada's Minister of Foreign Affairs, in a joint statement. "The accusations are baseless and unfounded." They warned the action would have a negative impact on American families who will have to pay more to build or renovate homes. They also said they would sue, if necessary.

"Today's ruling confirms that Canadian lumber mills are subsidized by their government and benefit from timber pricing policies and other subsidies which harm U.S. manufacturers and workers," said U.S. Lumber Coalition Legal Chair, Cameron Krauss.

"We appreciate today's actions by the Department of Commerce, which has examined massive amounts of evidence presented by the COALITION, the Canadian industry and the Canadian Federal and provincial governments. The COALITION is hopeful that the duties imposed by today's decision will begin the process of creating a level playing field for the future and allow for U.S. manufacturers to make essential investments and expand the domestic lumber industry to its natural market and protect and grow the jobs that are so essential to our workers and our communities," Krauss added.

"This is all about jobs," said Steve Swanson of the Swanson Group, owner of a plywood mill in Springfield, OR and sawmills in Roseburg and Glendale. "We should be able to add a few employees—25 to 30 workers—in each of our sawmills."

What’s Next? Market Dynamics

The North American softwood lumber dispute is a very complex issue that runs much deeper than most of the reporting, and there are a number of factors at work.

- While US lumber consumption was up roughly 10 percent from 2015 to 2016, US production only increased by 3.4 percent. This is also more consumption than would be apparent by relatively flat housing starts, suggesting that other market forces are contributing to the demand. Strong gains in home remodeling and repair activity are also driving consumption, and national remodeling spending is projected to reach nearly $320 billion by early 2018.

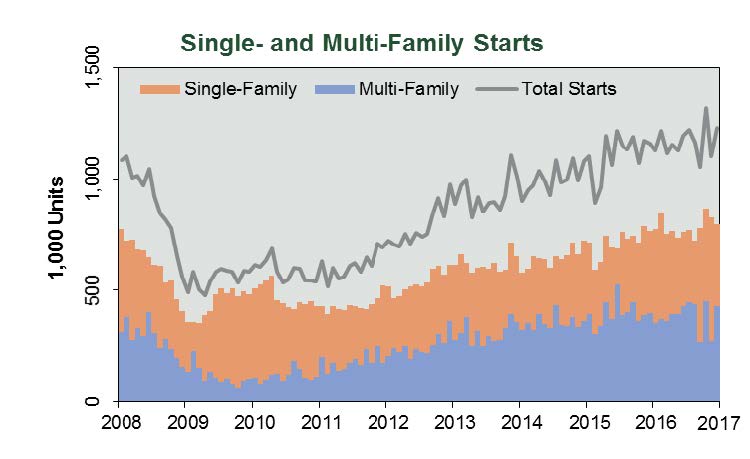

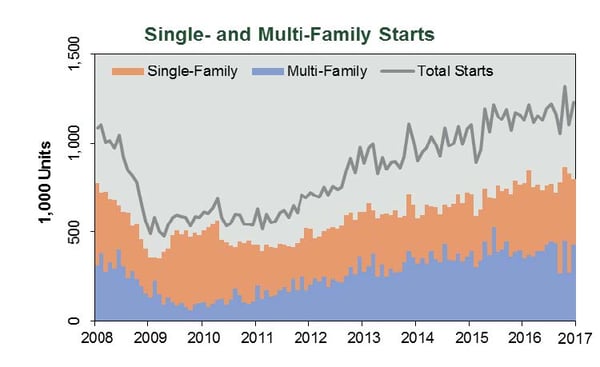

- If Forest2Market’s projections for 2018 are correct, we will see housing starts at around the 1.3 million mark, which will cause US lumber demand to rise above 50 billion MBF for the first time since 2007. If the economy continues to improve, lumber demand will remain strong in the near term. Under-building in recent years and current tight inventories have contributed to a situation where there is pent-up demand and millions of millennials on the cusp of household formation; while we don’t see housing starts approaching the pre-2008 sky high levels, something has to give.

- Southern yellow pine production in the US South has now far surpassed the Pacific Northwest (PNW) regional production. Canadian companies who now control about 1/3 of the southern softwood market have ramped up production to take advantage of the relatively cheap and abundant pine saw log supply in the US South. These companies made proactive market adjustments and sought to retain market share as interior BC sawmills succumbed to the loss of marketable timber as a result of the Mountain Pine Beetle (MPB) infestation. There is currently little room for PNW producers to compete and grow, as the West is largely timber-constrained. In Oregon, for instance, nearly 2/3 of the forests are publicly-owned, and there is little reason to believe the political and social reasoning that resulted in substantial harvest reductions in the 1990's will change anytime soon.

- Imports from BC to the US were up over 25 percent in 2016, and Canadian production for the year was up 6 percent—nearly double that of US producers. BC specifically showed a slight production increase, although it's only a matter of time until the region experiences some steep declines in production due to the lack of logs from the MPB-damaged forests. There is some indication that the spruce budworm (another tree-killing insect) may be attacking spruce-fir forests farther to the north and east. Even though Canadian government harvest license policy encourages forest production and employment, a substantial loss of forest inventory and the resulting decline in sustainable harvest levels cannot be overcome.

- As the US dollar maintains a relatively strong position globally, the Canadian dollar continues to soften amid flat/declining oil prices. Canadian lumber producers have a roughly 30 percent cost advantage (one US dollar will bring $1.36 in Canadian funds). Given the exchange rate situation, the falling value of the Canadian dollar makes Canadian lumber more appealing in a global market. Despite any new duties imposed by the US, China’s steady demand for western lumber gives Canadian producers and exporters an edge in an enormous market. However, Canada has recently slipped to the #2 supplier to China behind Russia, as Canadian lumber has been exported to the US in increasing volumes over the last year.

- Lumber prices have risen pretty dramatically over the past six months with increased demand, which begs the question: How much of this increase was due to anticipation of imminent US duties and if that has been the catalyst, why did Canadian producers push so much lumber across the border after the SLA expired? Was there a long-term strategy behind this move, or was it simply an opportunity to “get it while the getting was good"? Either way, such actions could be construed as “dumping” lumber, and would at some point warrant a response by the US Department of Commerce.

Market Opportunities

- It's very unlikely that the coastal BC industry will rebound and recover a significant share of the lost market opportunity in the near term. These producers are subject to high logging costs, environmental constraints, limited mill infrastructure, and they must increasingly depend on lower-value hemlock timber. Some other BC producers have invested in facility upgrades to increase production in forest areas with fir and spruce that haven't been subject to MPB damage. Lumber production and investment in the "prairie provinces" between BC and Quebec have also increased. Consolidations and improved efficiencies can put BC producers in a better situation to cope with any duties imposed by the US while maintaining margins.

- Currently, lumber imports to the US from the Baltic Rim and South America are limited, and any future imports will certainly depend on North American production, price and supply and demand relationships. As many Scandinavian manufacturers continue to become more competitive globally, and as US prices remain high amid strong demand, this market scenario really opens the door for new international players. Look for South American and Baltic Rim producers to enter the US market more confidently in the coming months.

- The US housing/remodeling industry and China are the two largest consumers of lumber on a global level. New Zealand is the largest exporter of softwood logs to China, and Australian forestry also relies to some extent on Chinese sales. But North American logs and lumber are a big part of the Chinese supply as well. It will be essential for southern hemisphere plantation forests, sawmills and pulp mills to keep an eye on profitability amid the rise in competing products as they continue to maintain a large presence in China.

It’s important to keep in mind that this latest lumber market dynamic between the US and Canada is nothing new; the Softwood Lumber Agreement enforced similar trade restrictions for 10 years before it sunsetted in 2016. With US-imposed duties scheduled to take effect in the coming weeks—just as building season really begins to take off—global lumber producers and consumers will be watching the US market carefully. Opportunities are on the horizon for those producers that have been planning, restructuring and waiting patiently on the sidelines to enter the US market.