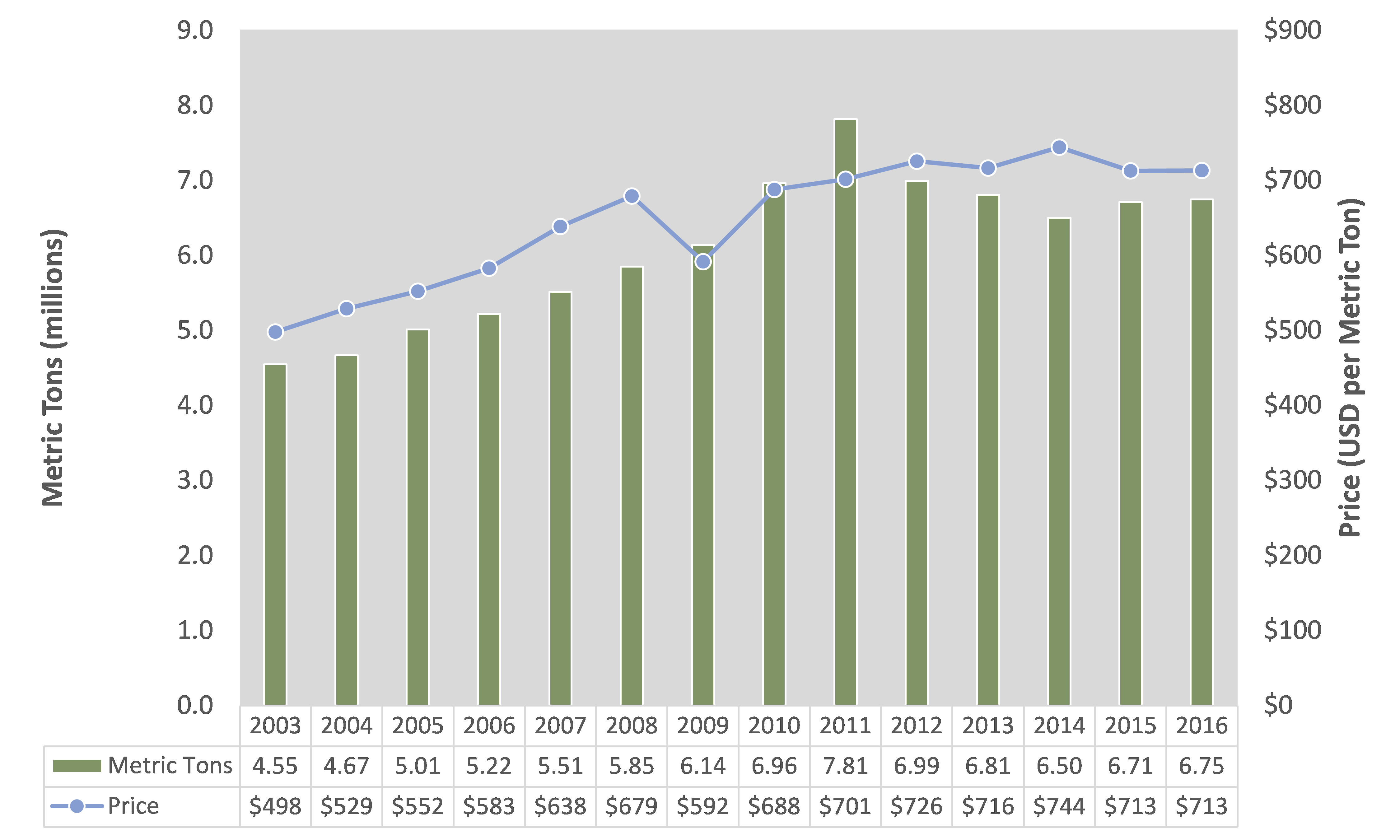

According to updated September trade statistics from the US Census Bureau and the United Nations, US exports of total market pulp are on track to flatten in 2016 (Figure 1). At their current pace, exports will reach 6.75 million metric tons, slightly up from 6.71 million in 2015, but below peak years between 2010 and 2013. Export prices will also be flat at $713 per metric ton[1].

Figure 1: US Market Pulp Exports, 2003-2016

Figure 1: US Market Pulp Exports, 2003-2016

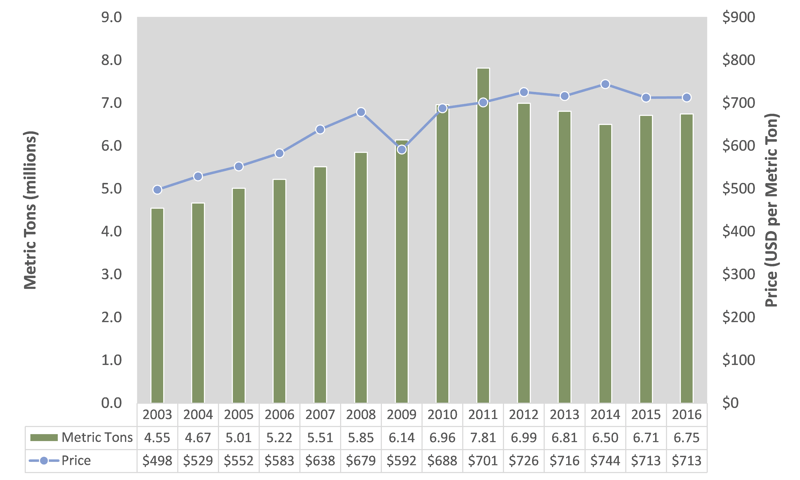

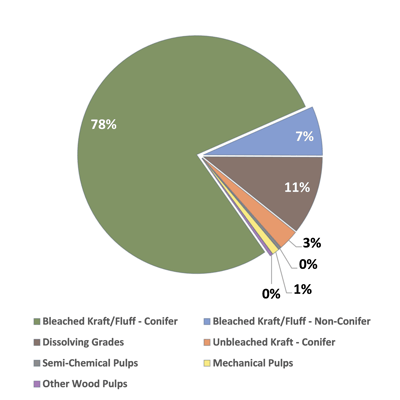

When diving into the data, exports of the lesser traded pulp grades are declining. Dissolving pulps and the bellwether grade of bleached conifer kraft/fluff pulp[2] are driving the increase in total pulp exports. This is not surprising as bleached conifer kraft/fluff is on target to be 78 percent of pulp exports, increasing from 5.0 million metric tons in 2015 to 5.272 million metric tons in 2016 (Figure 2 and Figure 3).

Figure 2: Percent of US Market Pulp Exports by Grade, 2016

Figure 2: Percent of US Market Pulp Exports by Grade, 2016

Figure 3: Metric Tons of US Market Pulp Exports and Imports, 2016

Figure 3: Metric Tons of US Market Pulp Exports and Imports, 2016

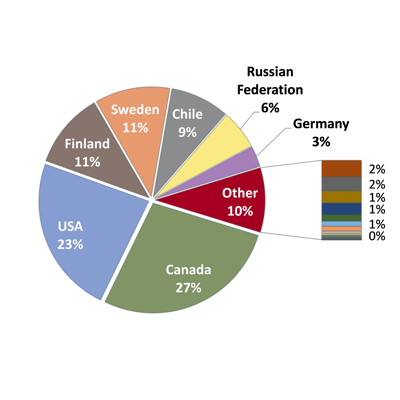

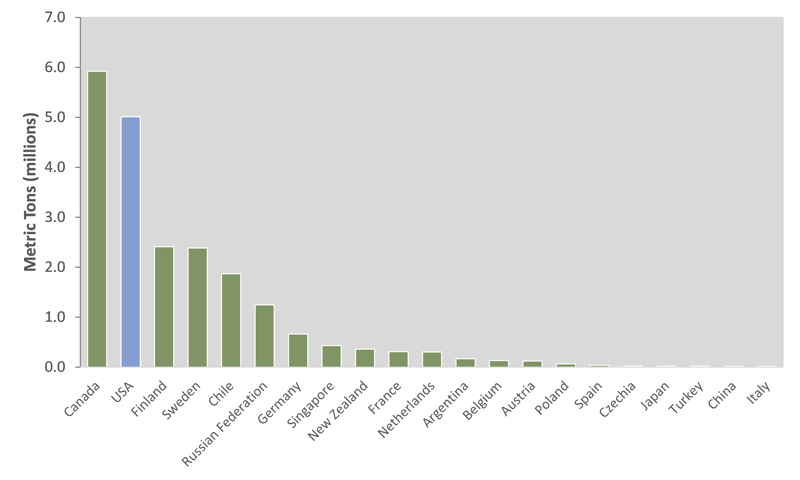

For bleached conifer kraft/fluff pulp, it will be interesting to see when final 2016 numbers are released if the US gained market share against other world producers, particularly Canada (Figure 4 and Figure 5).

Figure 4: Percent of Bleached Conifer Kraft/Fluff Market Pulp Exports by Top Producing Countries, 2015

Figure 4: Percent of Bleached Conifer Kraft/Fluff Market Pulp Exports by Top Producing Countries, 2015

Figure 5: Metric Tons of Bleached Conifer Kraft/Fluff Market Pulp Exports by Top Producing Countries, 2015

Figure 5: Metric Tons of Bleached Conifer Kraft/Fluff Market Pulp Exports by Top Producing Countries, 2015

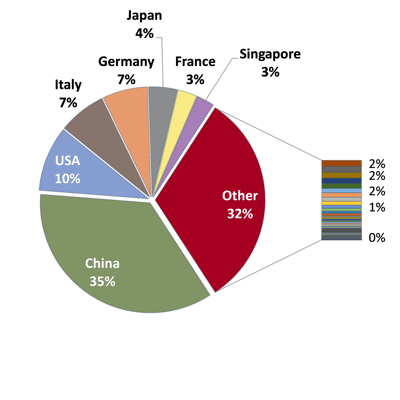

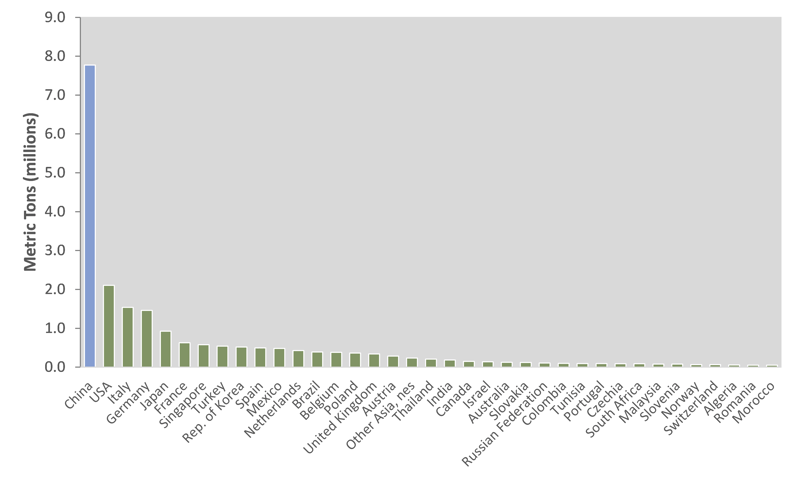

As the world’s largest consumer, China appears to be increasing its imports by 11 percent this year – from roughly 7.8 to 8.6 million metric tons (Figure 6 and Figure 7).

Figure 6: Percent of Bleached Conifer Kraft/Fluff Market Pulp Imports by Top Consuming Countries, 2015

Figure 7: Metric Tons of Bleached Conifer Kraft/Fluff Market Pulp Imports by Top Consuming Countries, 2015

Figure 7: Metric Tons of Bleached Conifer Kraft/Fluff Market Pulp Imports by Top Consuming Countries, 2015

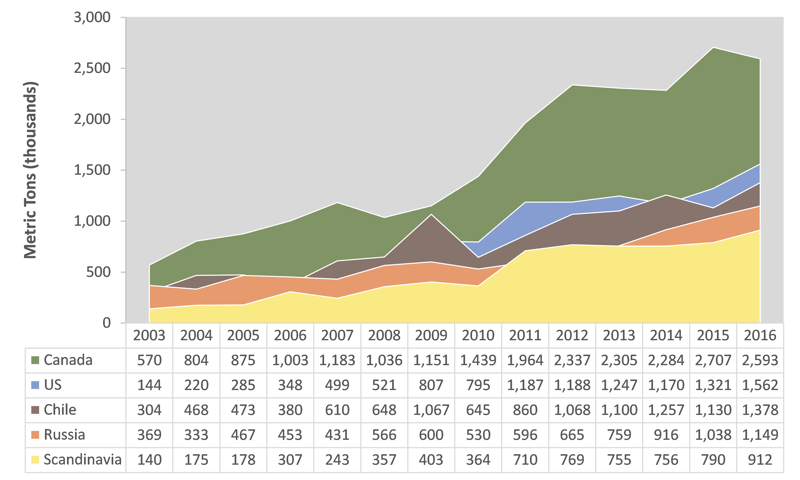

Canada’s exports to China appear to be shrinking in 2016 while the US, Chile, Russia[3] and Scandinavia are on track to gain roughly 150,000 metric tons each (13-15 percent) (Figure 8).

Figure 8: Metric Tons of Bleached Conifer Kraft/Fluff Market Pulp Exports to China by Top Producing Countries, 2003-2016

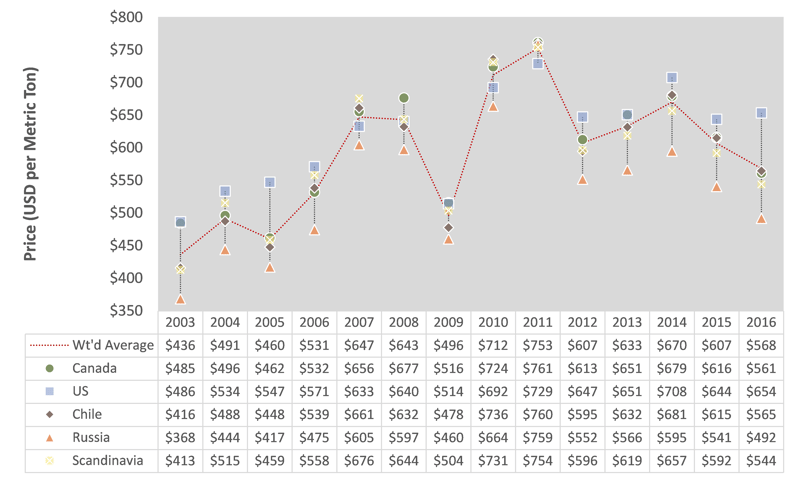

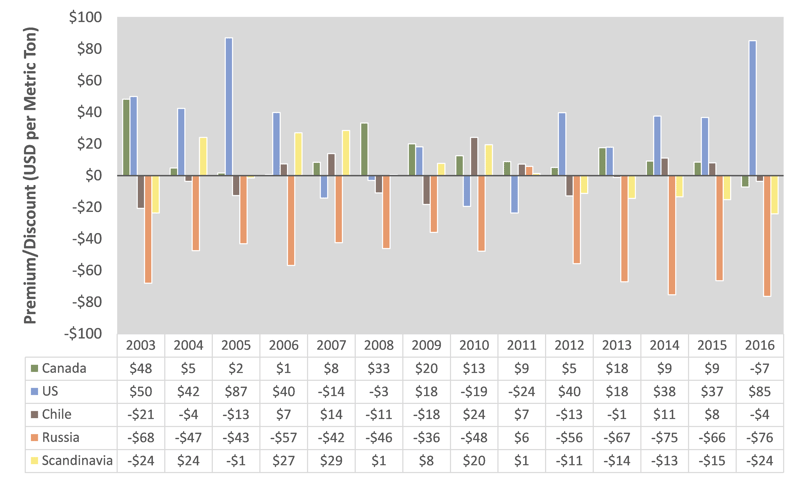

The fact that the US is increasing export volume is impressive considering the strength of the dollar against other currencies. From a price standpoint, US exports are on track to be up $10 per metric ton from 2015’s $644 per metric ton while other countries (especially Russia) have been able to offer market pulp at a reduced price compared to the average due to the exchange rate (Figure 9). We believe this points to steady demand for fluff pulp from the US.

The strength of the US dollar and its price point should have eroded export volume, as it has done with other pulps that aren’t traded as heavily. Instead, the opposite has occurred. As our outlook for the dollar is projected to weaken into 2017—particularly against the Canadian dollar—and as demand is projected to increase from China by 2-3 percent, the outlook for US market kraft and fluff producers in 2017 looks positive.

Figure 9: Price per Metric Ton of Bleached Conifer Kraft/Fluff Market Pulp Exports to China by Top Producing Countries, 2003-2016

Figure 10: Price per Metric Ton Premium/Discount Compared to Average of Bleached Conifer Kraft/Fluff Market Pulp Exports to China by Top Producing Countries, 2003-2016

Figure 10: Price per Metric Ton Premium/Discount Compared to Average of Bleached Conifer Kraft/Fluff Market Pulp Exports to China by Top Producing Countries, 2003-2016

[1] Export prices are FOB price to border of the exporting country alongside ship and exclude loading, insurance and transportation costs beyond the port of exportation.

[2] Trade statistics do not separate Southern Bleached Softwood Kraft (SBSK), Northern Bleached Softwood Kraft (NBSK) and fluff pulps.

[3] Projected, not actual.

Daniel Stuber

Daniel Stuber