4 min read

US South Biomass Feedstock Supply for Asian Biopower Producers

Gabe Rogers : March 1, 2017

As biopower markets in Asia mature, the increased competition for wood pellets and chips will provide opportunities for suppliers of these materials around the globe. Because biomass pellets can be made with low-cost wood raw materials and the cost of shipping is low, the number of potential suppliers is significant. Biopower producers in Japan and South Korea will require a secure and consistent supply of biomass feedstock, sometimes from multiple suppliers in multiple geographies. As a result, they will require strong procurement strategies, supply chain risk assessments, cost analyses, supplier diligence processes and contract negotiation strategies.

This post is the first in a series that will examine specific regions around the globe that are potential suppliers to Asian markets.

With over 100 wood-fiber pulping and pelletizing mills and over 200 solid-wood manufacturing facilities, US South forests are the most utilized forests in the world. Even though there is slightly more mature hardwood timber, the conifer species of pine loblolly and pine slash are the main timber species harvested in the region. The regional timber market is mature and developed, and prices for timber are highly related to demand for lumber, panels, paper, containerboard and pellets.

Forest Inventory

The US South land base consists of 437 million acres (177 million hectares), of which approximately 37 percent is timberland (Figure 1-1). The total inventory of stemwood is 12.1 billion metric tons, which is almost evenly split between hardwoods and pines. However, pine makes up 75 percent of total harvests (198 million metric tons), while hardwood makes up 25 percent (68 million metric tons). In total, only 2.2 percent of pine and hardwood inventory is harvested annually, assuring a sustainable supply.

Figure 1-1 US South Land Base

Pellet and Chipmill Supply

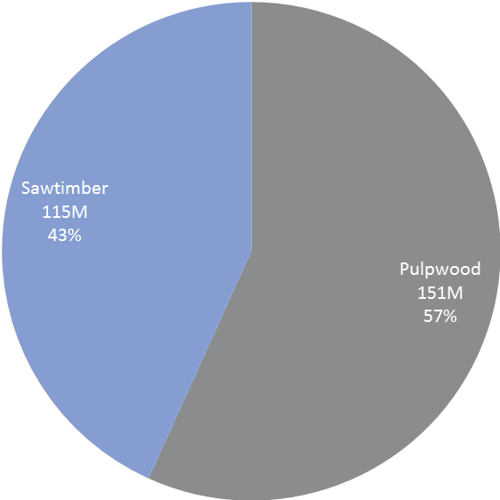

Most of the supply delivered to pellet and chipmills is harvested as small-diameter, tree-length logs classified as “pulpwood,” as well as the top stemwood portion (or “topwood”) of larger-diameter logs classified as “sawtimber.” Pulpwood and topwood are harvested most frequently at 151 million metric tons, while sawtimber is harvested at 115 million metric tons (Figure 1-2).

Figure 1-2 Pulpwood vs Sawtimber Harvests (in metric tons) – US South

Pulpwood and topwood are typically delivered to pulp/paper mills, but also to oriented strand board (OSB), pellet and wood chip mills. Sawtimber is delivered to lumber and plywood mills. While sawtimber is not typically delivered to pellet mills (it is best processed by lumber and plywood manufacturers), the wood chips created as a by-product are. Roughly 26 million metric tons of residual chips are generated annually in the US South. These wood chips are a source of supply for pellet mills.

At the end of 2016, 17 active pellet mills produced 4.6 million metric tons in the US South. Two new pellet mills are scheduled to come online in 2017, and one is under construction. Together, these new mills are expecting to add a production capacity of 1.5 million metric tons annually.

Ownership/Supply Chain Characteristics

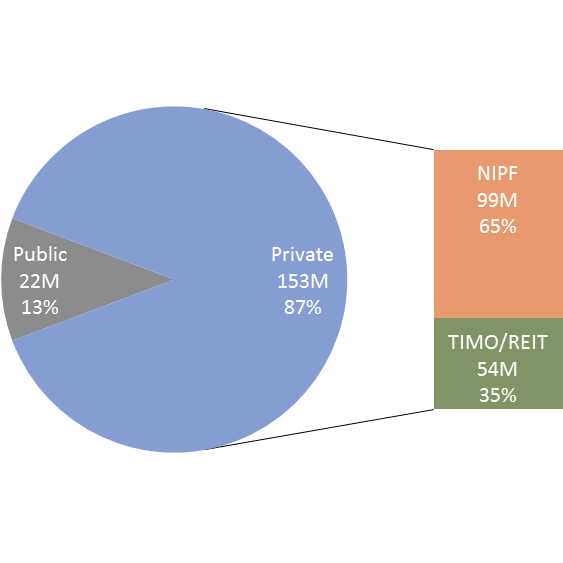

A majority of the timberland in the US South is owned by private landowners (non-industrial private forest [NIPF] landowners, timber investment management organizations [TIMOs], or real estate investment trusts [REITs]) (Figure 1-3). Most NIPF land is fragmented with tract sizes that can be as low as 1-5 acres (.5-2 hectares); the average tract size is approximately 50 acres (20 hectares). Due to this fragmentation, most mills do not maintain a dedicated timber procurement staff. Rather, a network of independent loggers and suppliers procure wood and either deliver it directly to the mill upon harvest, or hold it for a longer period as inventory (typically not as physical inventory, but as wood under contract).

Figure 1-3 Distribution of Timberland Owners (in hectares) – US South

Timber sale contracts between buyers and sellers—generally for single tracts of timber—are made at an agreed-upon price called “stumpage.” Logging and harvesting are contracted and priced separately. Mills typically do not take ownership or pay for timber until the supplier actually delivers to the mill; the supplier bears all of the risk until the delivery is complete.

While this market structure seems to suggest an uncertainty of supply for mills, they can further guarantee supply by:

- Entering into a supply agreement with a large landowner such as a TIMO or REIT. (As many firms in the forest industry began to sell or convert their timberland holdings, TIMOs and REITs filled the ownership gap. These management systems have the capital to purchase and manage vast acreages of timberland, they have a more contiguous land base, and they can furnish a larger amount of supply.)

- Maximizing production from the most efficient suppliers.

- Maintaining enough inventory on-hand, typically two weeks of operational supply.

Feedstock Costs

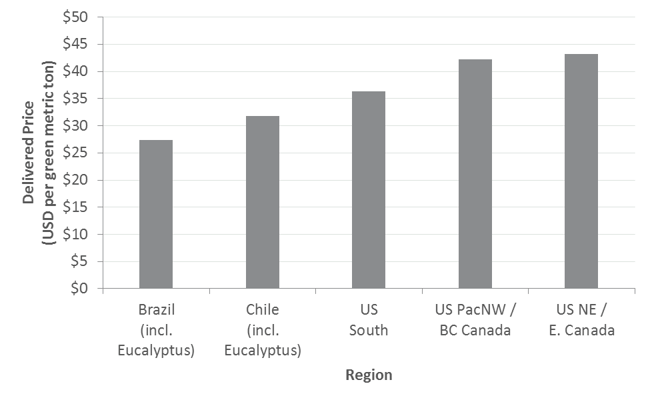

Asian biomass buyers may be considering multiple options for sourcing their wood feedstock—either as dry wood pellets, green wood chips or as dry wood chips (pine is presumed to be the primary species used). The US South offers a stable and low-cost source of pine wood fiber when compared to other global regions (Figure 1-4). This is due to the region’s diversity of ownership, well-developed supply infrastructure, low cost of capital, significant and sustainable supply and a mature and efficient supply chain.

Figure 1-4 Global Pine Pulpwood Price (in metric tons)

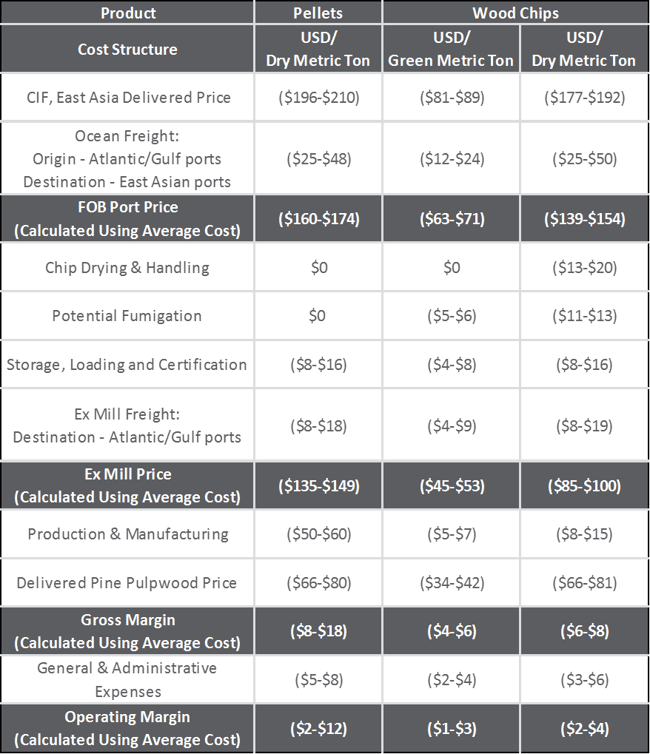

Using two wood basins in the US South—one in the Gulf market and one in the Southeast Atlantic market—Forest2Market has developed an example cost tree where pulpwood delivered to a pellet mill or wood chip mill would average $34 to $42 per green metric ton ($66 to $81 per dry metric ton) (Table 1-1).

Making a determination between pellets and wood chip type (dry or green) is important, as there are advantages and disadvantages to each product. Manufacturing costs, margins and general and administrative expenses will be less for wood chip mills compared to pellet mills. Wood chip mills typically require less labor and use a simpler manufacturing process, which would seemingly make wood chips a lower-cost product.

However, when additional processing costs are taken into consideration, the price gap between wood chips and pellets closes. First, it is likely that fumigation and heat treatment of wood chips will be required to kill quarantine pests such as nematodes. More importantly, most of the weight (slightly less than half) of wood chips is native moisture content. As a result, an Asian biomass boiler will have to accommodate for moisture, steam byproduct and lower thermal output. Or, an Asian biopower producer will have to dry the chips at some point in the process (likely prior to shipping), at which point the price gap between pellets and wood chips closes.

Regardless of which feedstock type is selected, it is important to recognize that pulpwood costs will comprise a large portion of the final product’s delivered price. For Asian biomass consumers, identifying the ideal regional market for a feedstock source will be key to understanding the feedstock input price for its facility.

Table 1-1 Cost of Pellets vs Wood Chips from Atlantic/Gulf ports to East Asian ports