2 min read

US South Stumpage Market Trends: YTD 2015 Results and Historic Data

Daniel Stuber

:

October 28, 2015

Daniel Stuber

:

October 28, 2015

As we approach the end of the year, it’s a good time to analyze year-to-date (YTD) and historical stumpage market trends and prices in the US South. While winter seasonal pressure typically drives prices higher, I want to take note of the data before 4Q affects the market.

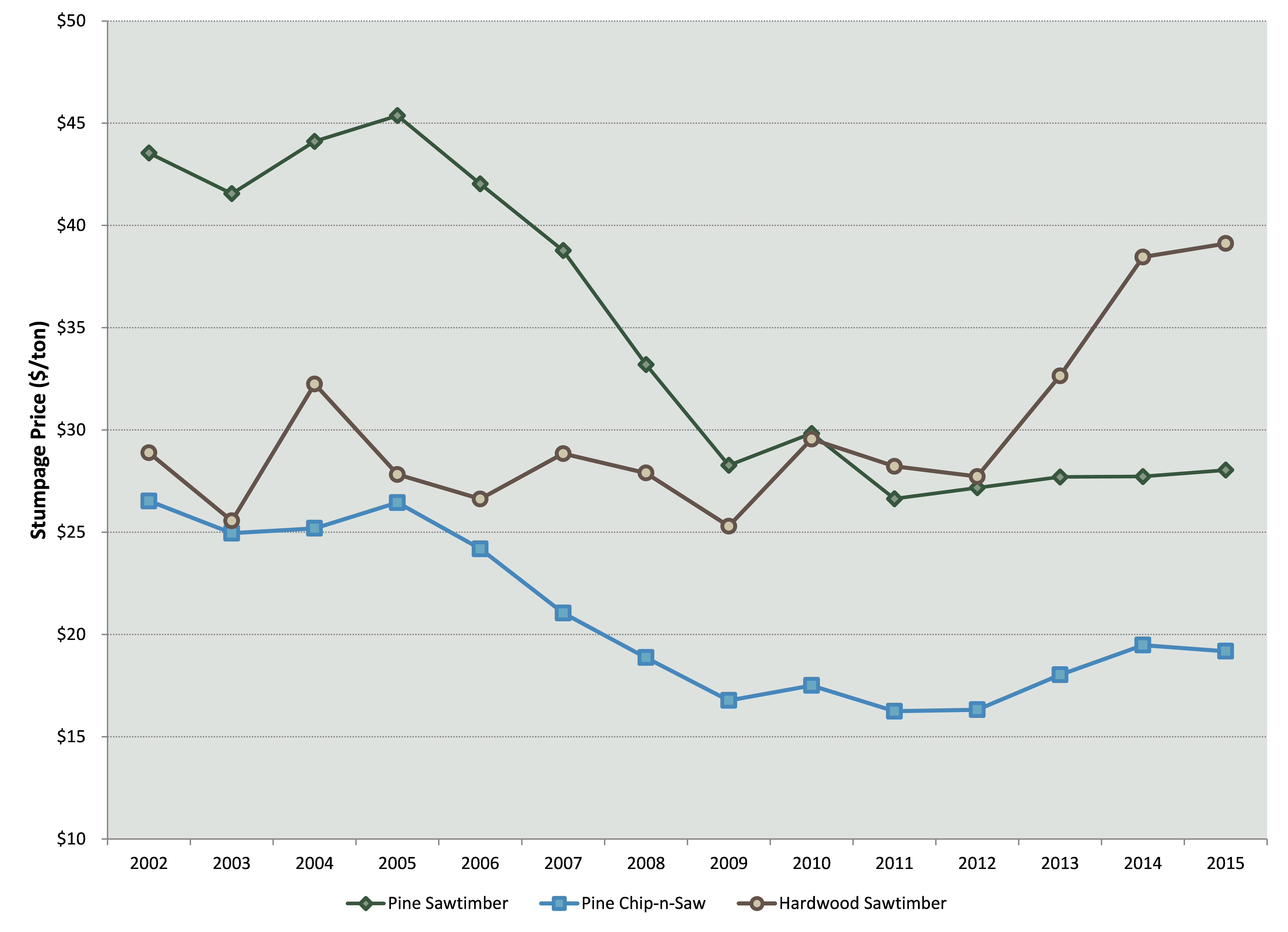

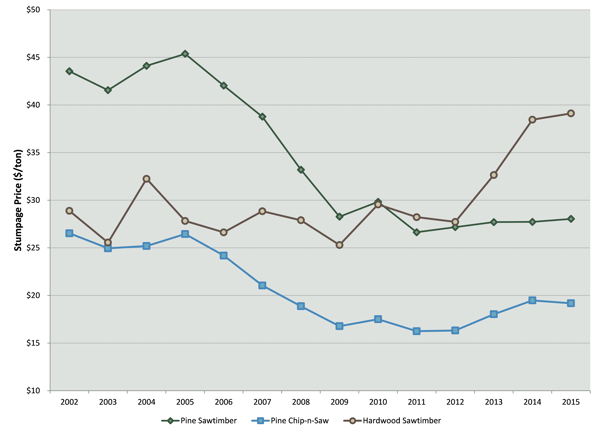

Sawtimber, Chip-n-Saw

A comparison of 2015 YTD average prices over the same period in 2014 shows that sawtimber prices increased while chip-n-saw prices softened.

-

Chip-n-Saw (CNS) currently averages $19.18/ton, which represents a $0.30/ton or 1.5% decrease.

-

Pine Sawtimber currently averages $28.04/ton, which represents a $0.31/ton or 1.1% increase.

-

Hardwood Sawtimber currently averages $39.12/ton, which represents a $0.66/ton or 1.7% increase.

As with any complex raw materials market, a number of variables affect these prices:

-

Even though the price of lumber has fallen since the beginning of year, production and output have trended up; sawlog purchases are up roughly 3% over the same time period last year. Steady growth in the lumber market, particularly for wider dimension lumber, has heightened demand for larger diameter pine logs.

-

Pricing for narrow lumber has not increased as fast as wide dimension; as a result, demand for CNS has been weak. In addition, when high demand for pulpwood pushed pulpwood prices higher, this drove the CNS price floor higher. In 2015, however, pulpwood prices have softened and that, coupled with flatter demand for CNS, has caused the price floor for CNS to fall slightly.

-

Hardwood Sawtimber price increased at the beginning of the year due to a strong export market, but it has dipped during the latter half of the year as the dollar has strengthened. The overall annual average YTD remains above 2014, however.

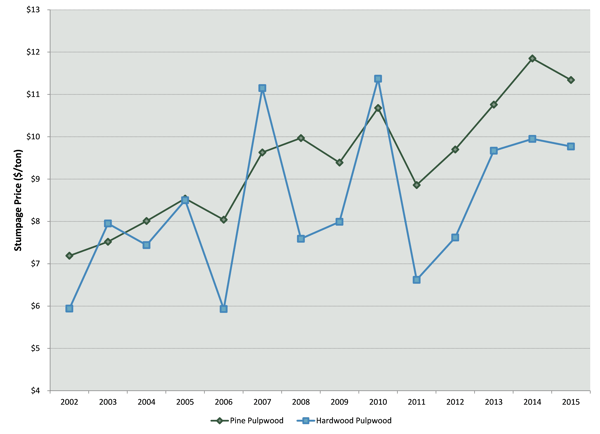

Pulpwood

Pulpwood prices decreased YTD 2015 over 2014 averages.

-

Pine pulpwood currently averages $11.34/ton, which represents a $0.51/ton or 4.3% decrease.

-

Hardwood pulpwood currently averages $9.77/ton, which represents a $0.18/ton or 1.8% decrease.

Two supply and demand factors account for changes in the pulpwood market this year.

-

Demand has increased slightly YTD 2015; this would typically drive a price increase, but falling prices indicate that the market has become increasingly supply-side driven.

-

Pent-up supply is being released into the market. As noted in the sawtimber data above, prices for sawtimber are up as demand from sawmills has increased YTD. This has led to an increase in clearcuts, which has subsequently led to an increase in the available supply of pulpwood, as well as the residual chip supply in the market. Such conditions have caused downward price pressure on pulpwood.

Outlook

In the near-term, timber prices will be variable. Uncertainty in the economy will be one reason. The Federal Reserve has yet to decide whether a rate hike will occur this year, and growth will remain sluggish at best. Many industry insiders and observers predicted a surge in lumber imports from Canada— a “wall of wood”—due to the expiration of the Softwood Lumber Agreement (SLA), but that has not materialized thus far. In fact, lumber prices have increased and last month’s housing numbers were positive, so sawlog demand will likely continue to grow. Unless supply continues to become more available, pulpwood pricing may also rebound. Because OSB prices are improving and pellet demand is on course to increase (particularly in Arkansas, Louisiana and Texas), demand may indeed outpace the increased supply, causing prices to rise.