US South timber prices during 3Q2018 were mixed. Pulpwood products increased significantly and pine log products decreased slightly, but the general trend of timber prices was up +1.5 percent in 3Q.

Pulpwood

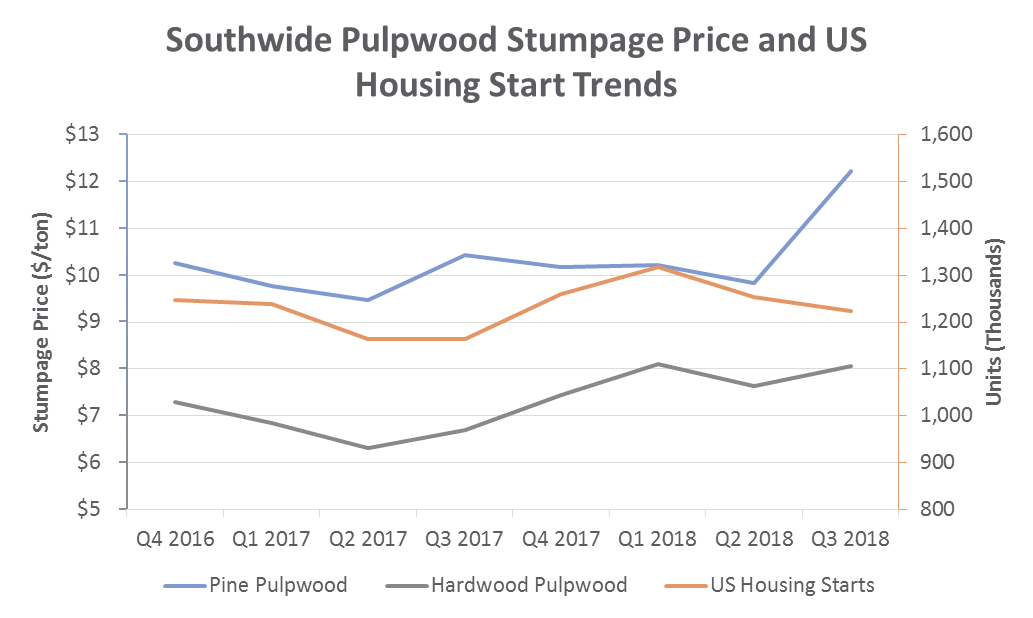

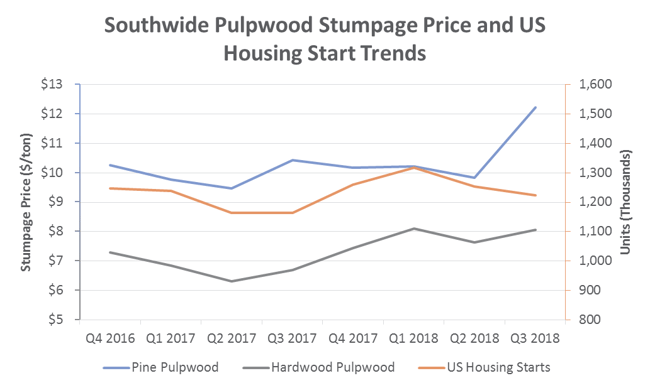

On a Southwide basis, pine pulpwood prices surged +24.2 percent to $12.22/ton during 3Q2018, and all three regions saw prices increase for this product. The East-South experienced the largest increase of +22.8 percent to $15.56/ton; the West-South rose +16.7 percent to $7.76/ton; and the Mid-South increased +10.1 percent to $9.07/ton.

Hardwood pulpwood prices Southwide also increased, rising +5.6 percent during 3Q to $8.07/ton despite declines in two regions. The West-South region experienced the largest drop of -13.2 percent to $9.76/ton, and the East-South decreased by -6.2 percent to $4.42/ton. The Mid-South, however, rose +12.2 percent to $10.01/ton.

Pine Logs

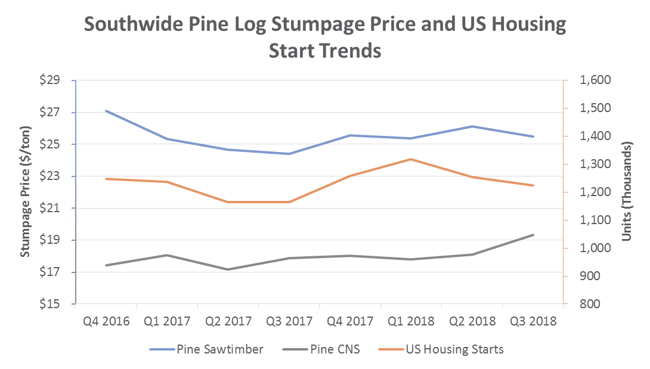

Pine chip-n-saw prices showed a steady increase of +6.8 percent to $19.33/ton on a Southwide basis. The East-South and Mid-South regions increased +6.0 percent to $22.11/ton, and +0.7 percent to $17.26/ton, respectively. Conversely, the West-South region dropped -7.4 percent to $11.89/ton.

Pine sawtimber prices dipped slightly, decreasing -2.4 percent to a Southwide average of $25.47/ton. All three regions experienced decreases in price: The West-South dropped -3.5 percent to $26.13/ton; the East-South was down -2.7 percent to $26.26/ton; and prices in the Mid-South dropped -1.4 percent to $24.61/ton.

Outlook

Real gross domestic product (GDP) increased at an annual rate of 3.5 percent in 3Q2018 according to the Bureau of Economic Analysis, matching its projected forecast of 3.5 percent. Fresh data from the Atlanta Federal Reserve’s GDPNow model estimates that real GDP growth (seasonally adjusted annual rate) in 4Q2018 will be 2.4 percent. The “nowcast” of 4Q real final sales of domestic product growth decreased from 2.9 percent to 2.7 percent after the recent employment report from the U.S. Bureau of Labor Statistics was released.

Housing starts have failed to meet expectations in 2018 and lumber prices have retreated as a result. As producers in the Pacific Northwest curtail operations due to high log prices and pinched margins, the US South will continue to meet any additional demand for sawtimber due to the region’s low log costs. Despite billions of dollars in timberland damage in the wake of Hurricanes Florence and Michael, an oversupply of large logs still remains available on the southern market. As a result, we look for sawtimber stumpage prices to remain flat through 4Q2018 and into 1Q2019. However, we look for pulpwood prices to continue to increase in the near term amid robust demand.