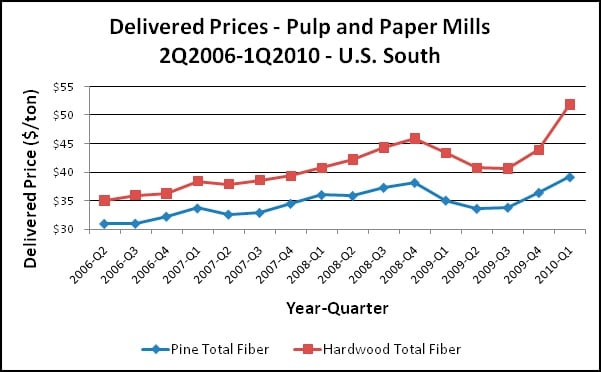

Higher delivered pulpwood costs in the South are one of the reasons for this parity. Since 3Q2009, delivered pulpwood prices have been trending significantly higher in the South. In 1Q2010, pine pulpwood (total fiber) prices increased 7 percent from 4Q2009 and 12 percent from 1Q2009. Hardwood pulpwood prices (total fiber) increased even more dramatically, climbing 18 percent quarter over quarter and 19 percent year over year (see graph).

In the first two months of the second quarter, prices have retreated. The average price for pulpwood across the South currently hovers at about $33/green ton. In the Puget Sound area, prices are at or above $30 per ton; in Oregon, prices are $25-$28 per ton.

Delivered prices in the West-South, converted to dollars per bone dry ton (BDT), average in the high $80s per BDT. In the Pacific Northwest, the region-wide average for total delivered conifer fiber (residue and whole log chips combined) is approximately $90 per BDT.

Higher prices in the South can be attributed to wet winter weather, some seasonality (prices are generally higher in the 1Q as mills replenish inventory), and the short supply of residue chips from sawmills (due to the reduced sawtimber harvests brought about by lackluster demand for housing). As a result, 85 percent of wood chips in the South are sourced from chipping roundwood.

The Pacific Northwest appears to be following the path of the South. Traditionally the mix for pulp mills in the PNW was approximately 20 percent whole log chips and 80 percent residual chips. The uptick in lumber production, because it was short lived, did little to increase residue chip availability in the Pacific Northwest. As a result, mills have been using a 40 (whole log chips)/60 (residue chips) or 50/50 mix.

The end of April marked the turning point for lumber prices. When the homebuyer tax credits expired, lumber prices began to retrench. Many mills began announcing early summer downtime so as not to flood a falling market. As a result, residual chip supply may be irregular this summer and increase demand for roundwood chips. Fiber costs may rise if this occurs, and mills in the Northwest will once again operate at a competitive disadvantage.

Suz-Anne Kinney

Suz-Anne Kinney