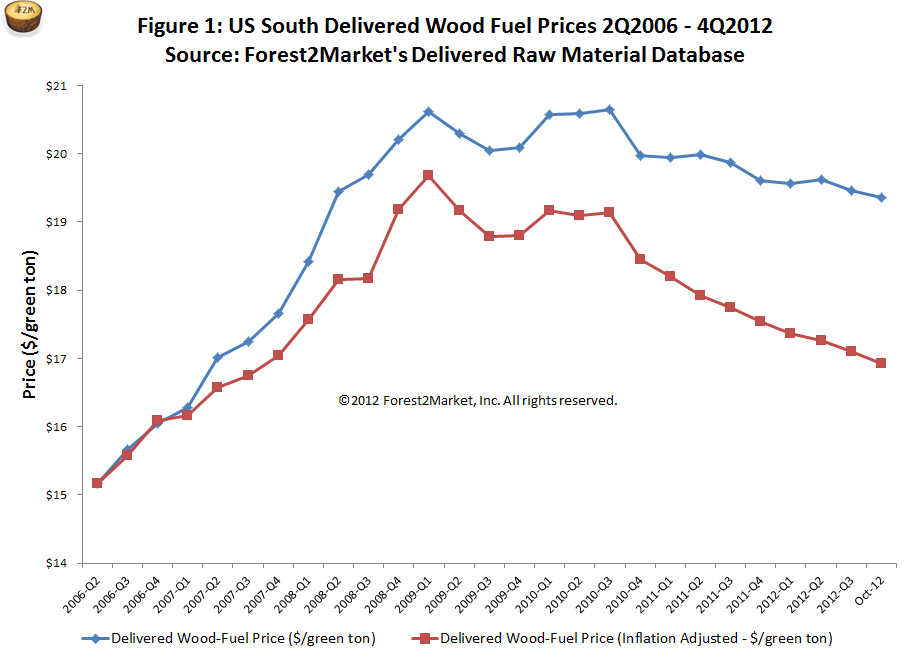

Wood-fuel prices have followed a downward trend since 3Q2010. Based on October 2012 and preliminary November 2012 data, we expect this trend will continue in 4Q2012.

Let’s look at the numbers. In 3Q2010, nominal wood-fuel prices averaged $20.65 per ton. In 4Q, nominal prices are on track to hit $19.36 per ton, a drop of 6.25 percent (Figure 1). If we convert these numbers to price per btu, the current price of $1.88 per btu is 11.7 percent below 3Q2010’s $2.13 per btu.

Why has this downward price trend been so persistent?

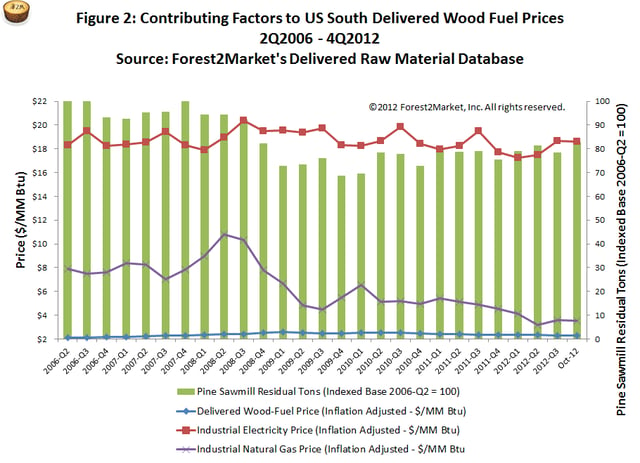

Well, it’s not because electricity and natural gas are falling. Between 2Q and 3Q of 2012, electricity prices rose from $17.09 per btu to $18.25 per btu a 6.8 percent increase. Natural gas prices rose 14.4 percent over the same period, up from $2.77 per btu to $3.17 per btu.

Why are wood-fuel prices falling when the price of competing sources of energy are higher?

The volume data in Forest2Market’s Delivered Raw Material database points to the cause of this discrepancy being a boost in the supply of wood fuel. Preliminary data suggest that the supply of sawmill residues, for instance, is likely to increase by 5 percent in 4Q2012 (spurred by a continuing recovery in the housing market and increased lumber production). Figure 2 illustrates the relationship between this hike in volume and price. When the supply of sawmill residues (green bar) is higher, the price of wood fuel (blue line) is lower. Over the 2Q2010 – 4Q2012 time frame, supply has trended higher and wood-fuel prices have decreased.

Another trend we have identified in the data is a demand driver. Pulp and paper companies have recently started buying more pulpwood shipped directly to the mill and relying less on chip mill chips. As a result, they have more bark (an internal source of wood fuel) on hand. With more internal wood fuel, pulp and paper companies do not need to buy as much wood fuel from outside sources.

What should we expect in 2013/2014?

As housing continues to recover and residual output continues to increase, prices should continue to fall. The data indicates that we are now at 83 percent of 2006’s residual output level. Wood-based electricity generation, according to the Energy Information Administration (EIA), fell from .19 quadrillion btu in 2011 to .16 quadrillion btu in 2012 (a drop of 16 percent). In keeping with this trend, we don’t expect demand for wood fuel to grow exponentially. As far as wood-fuel prices go, if the downward trend of the last few quarters continues, we expect that in roughly two years, prices will return to their 2006 level of $15-$16 per ton.

Read The Future of Biomass Power Generation.

Comments

01-07-2013

Interesting post. I’ve done some studies on the interconnection between prices of wood fuels and other fuels in a Scandinavian context and found no significant interrelation between crude oil and wood fuels. It’s interesting to see signs of this - somewhat counter-intuitive - disconnection in the US market as well.

Daniel Stuber

Daniel Stuber