1 min read

Canadian Lumber Tariffs Impacting Southern Yellow Pine Prices

Melissa Reynard : June 1, 2017

With the recently-announced tariffs on Canadian softwood lumber imports into the US, a lot of unanswered questions are floating around the market: How will the tariffs affect supply in the US? Will manufacturers ramp up production to meet seasonal demand? Will sustained high prices dampen US housing starts during peak building months? Will added costs discourage potential first-time home buyers?

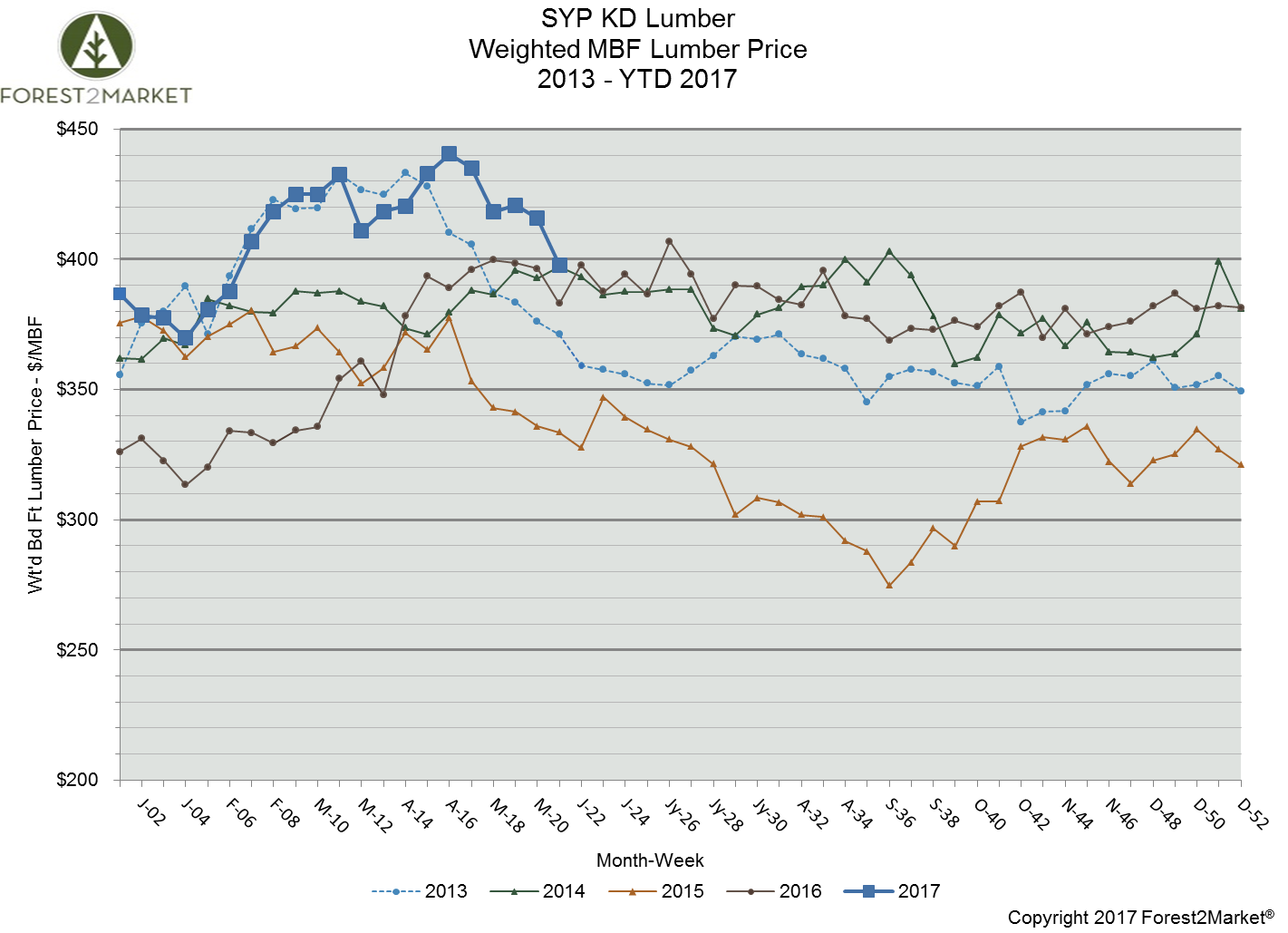

Forest2Market’s lumber data has showed steady price decreases since the new tariffs were announced at the end of April. Prices increased steadily through January and February before peaking at a 12-year high in April—perhaps in preparation for an impending tariff—which could account for the leveling of prices we’re seeing now.

Forest2Market’s data also shows a significant volume increase in #1 and #2 dimension products when comparing January to April. Even if lumber demand and prices were to spike in the coming weeks, the latent capacity at mills and the amount of domestic supply would keep the market from sustaining any kind of long-term price increase.

In March, housing starts declined an unexpected 6.8 percent, with multi-family units declining the most. While April’s decrease was not as severe (-2.6), it was not a standout month to kick off building season. The initial decline in lumber prices could be reflective of the lackluster housing starts numbers, which essentially caused mills to push more inventory to market in anticipation that prices would continue declining after the tariff implementation.

Reaction to the new lumber tariffs from within the forest products industry and beyond has been mixed, as expected. US homebuilders are not the only ones potentially affected by the tariff; it is speculated that single-family home prices will increase at a rate much higher than they have in the recent past. This compounds the challenges for new home buyers—particularly millennials—who are finding household formation increasingly difficult.

There is no question that current lumber prices are still high compared to previous years, but the downward trend—or at least some kind of equilibrium—will likely be the norm over the next few weeks. Until the market adjusts to both the new tariffs and the reaction from the homebuilding industry, producers will continue to operate in an uncertain environment.

A closer look at prices since the beginning of the year:

- 1Q2017 Average Price: $404/mbf

- April Average Price: $432/mbf

- January – May Peak Price: $440/mbf

- Average Price Since Tariff Announcement: $413/mbf